Navigation

Menu

Share this article

Share this article

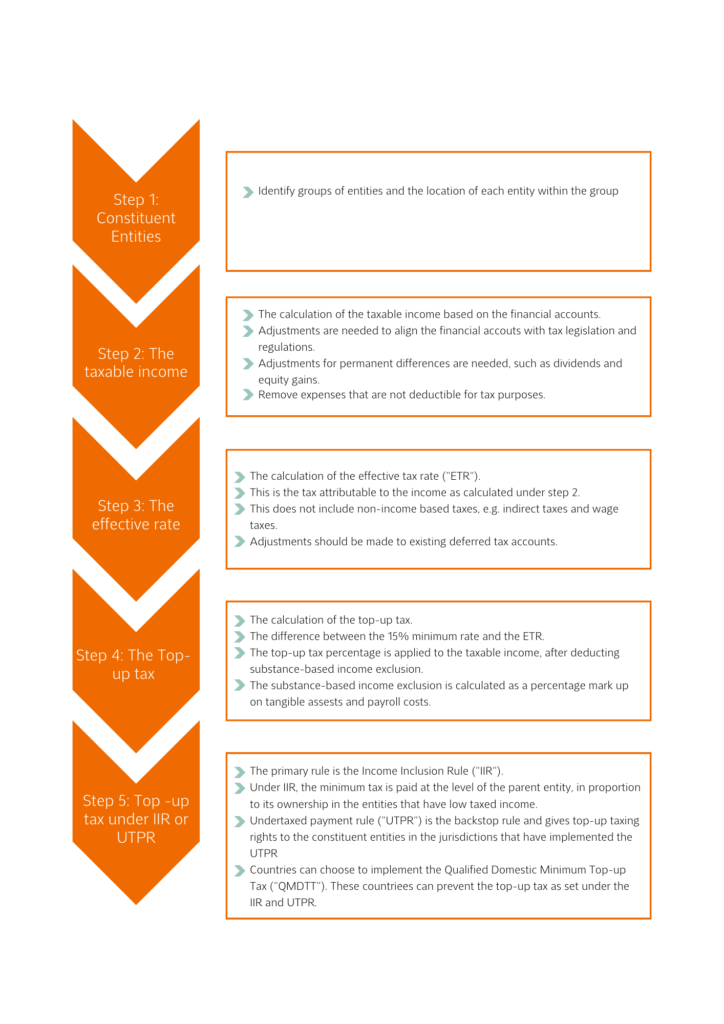

This new legislation entails that multinationals and domestic companies with a turnover of €750 million or more pay at least 15% in tax on their profits. This is determined by paying a top-up tax for the difference between the effective tax rate (“ETR”) in a country and the minimum tax rate of 15%. The minimum tax rate of 15% is an internationally agreed rate. In this factsheet, we aim to facilitate the process of determining the tax liability of a multinational corporation under the minimum tax legislation. In this regard, the following five (5) steps should be considered

The first step is to identify the taxpayers that fall within the scope of this new legislation. Taxpayers that either have no foreign presence or that have less than EUR 750 million in consolidated revenues are not in scope of the Minimum Tax. Some entities may also be exempted from this legislation.

The calculation of the taxable income is based on the financial accounts. Adjustments are required to align the financial accounts with tax legislation and regulations. Adjustments for permanent differences, such as dividends and equity gains, must be made. Additionally, expenses that are not deductible for tax purposes must be excluded.

If a Group is within the scope of the rules, it must calculate its ETR to determine whether it is at, below or above the minimum tax of 15%. The ETR calculation is done on a jurisdictional basis. This is the tax attributable to the income as calculated under step 2. The adjusted income and expenses are used to calculate the ETR.

A jurisdiction can introduce to impose a top-up tax on the low-taxed income of in-scope taxpayers for up to 15%. It requires in-scope Groups to calculate their income, and the taxes on that income, on a jurisdictional basis. If the calculation results in an ETR below 15%, the MNE Group is required to pay a top-up tax to bring the total amount of tax in that low-tax jurisdiction up to the 15% rate.

Top-up tax % = 15% – ETR

The primary rule is the Income Inclusion Rule (“IIR”). Under IIR, the minimum tax is paid at the level of the parent entity, in proportion to the entities that have low taxed income. Furthermore, Undertaxed Payment Rule (“UTPR”) is the backstop rule and gives top-up taxing rights to the constituent entities in the jurisdictions that have implemented the UTPR. Countries can choose to implement the Qualified Domestic Minimum Top-up Tax (“QMDTT”). This means that the subsidiary may also be imposed to the top-up tax, if the company is subjective to an effective tax rate less than 15%.

QDMTT = Top-up tax % x excess profit

Our team of seasoned tax practitioners can assist you with more information related to the Minimum Tax in Caribbean Netherlands and Pillar 2 in general if there are any ambiguities.

Should you have any questions regarding this announcement, please do not hesitate to contact us. Our team would be more than happy to assist you with your questions.